In a surprising development for the U.S. housing market, the interest rate on a 30-year fixed mortgage has seen its largest weekly drop in the past year. This positive shift comes amid growing speculation that the Federal Reserve will announce an interest rate cut next week. For Americans aiming to buy their dream home, this marks an opportune moment.

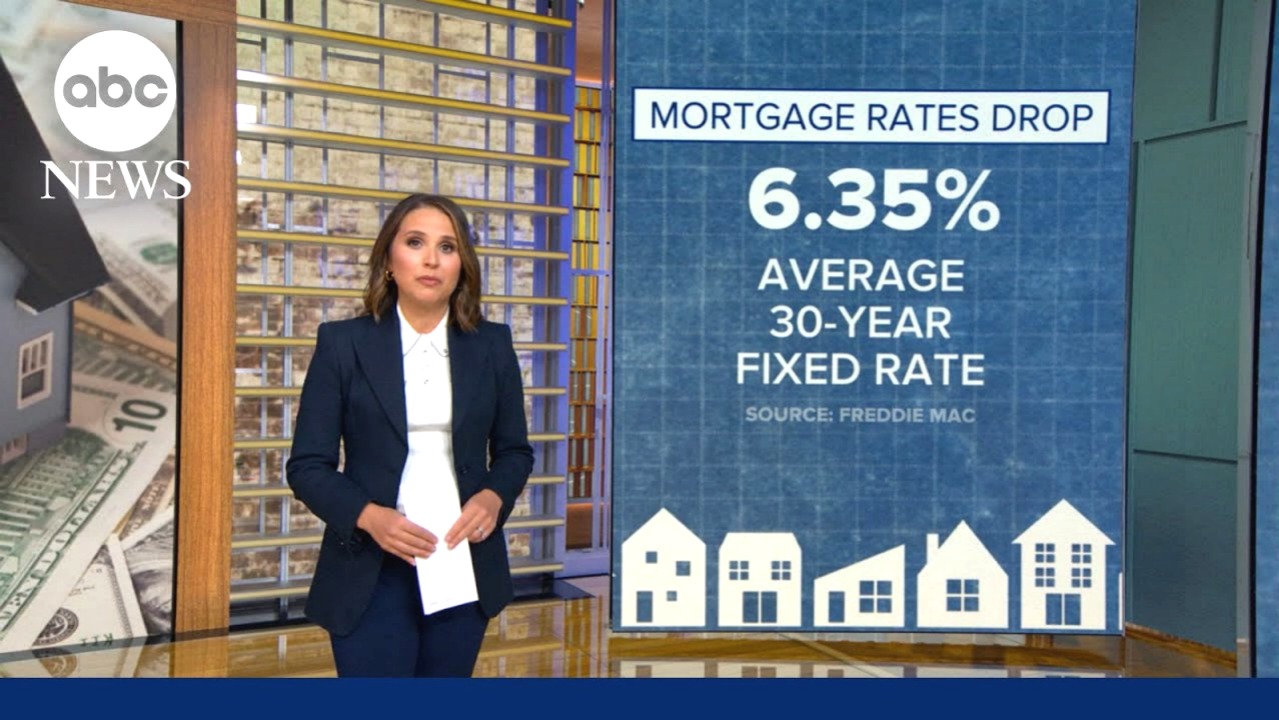

According to Elizabeth Schelsey, speaking in a recent morning broadcast, mortgage rates have now fallen to 6.35%, reaching their lowest level in nearly a year. For most of 2025, these rates lingered around the 7% mark, making homeownership a significant financial challenge for many. The recent decline offers much-needed relief to potential homebuyers, especially when considering their monthly budgets.

To put this into perspective, consider a $400,000 home loan with a 20% down payment. Today, the monthly mortgage payment is approximately $138 lower compared to January of this year when rates stood at 7%. Such a reduction in monthly outflow can greatly impact homebuyers’ financial planning, making homeownership slightly more attainable in an otherwise expensive market.

However, despite the falling mortgage rates, home prices remain at record highs across many U.S. cities. New data from real estate giant CBRE sheds light on this challenging landscape. The average monthly mortgage payment for a new home purchase currently stands at about $4,500. In comparison, leasing a new apartment costs an average of $2,200 per month. This indicates that, in today’s market, owning a home costs more than twice as much as renting.

This stark contrast is forcing many prospective buyers and homeowners considering refinancing to rethink their strategies. Elizabeth Schelsey suggests that one viable option worth exploring is an adjustable-rate mortgage (ARM). Unlike fixed-rate mortgages, ARMs typically offer lower initial rates, some of which are now below 6%. For buyers who do not plan to hold onto their property for the long term, or who expect their financial situation to improve in the coming years, this could be a cost-effective solution.

Experts emphasize that although lower mortgage rates are a welcome relief, buyers should proceed with caution. The housing market remains volatile, with high home prices continuing to be a significant barrier to entry. Furthermore, the anticipated Federal Reserve decision next week could further influence market dynamics.

In summary, the drop in 30-year fixed mortgage rates is a breath of fresh air for many Americans aspiring to own a home. With rates now at 6.35%—the lowest in nearly a year—potential homebuyers and refinancers should seriously consider taking advantage of this window of opportunity. However, balancing this against persistently high home prices and market unpredictability remains critical.

For those in the market this fall, keeping an eye on the Federal Reserve’s upcoming decision, as well as exploring alternative mortgage options such as adjustable-rate plans, may offer financial benefits in the long run.

This article is crafted to be SEO-friendly, focusing on keywords such as “30-year fixed mortgage rate,” “adjustable rate mortgage,” “home prices,” “mortgage payments,” and “Federal Reserve rate cut.” It is presented in a professional news format with clear, easy-to-read paragraphs.